Employee strike activity has been on the decline over the last five decades, a new study argues that household indebtedness is the reason why.

The evidence provided in the study proves a strong support to this argument for the cases of Korea, Japan, Sweden, the United States and the United Kingdom over the period 1970–2018.

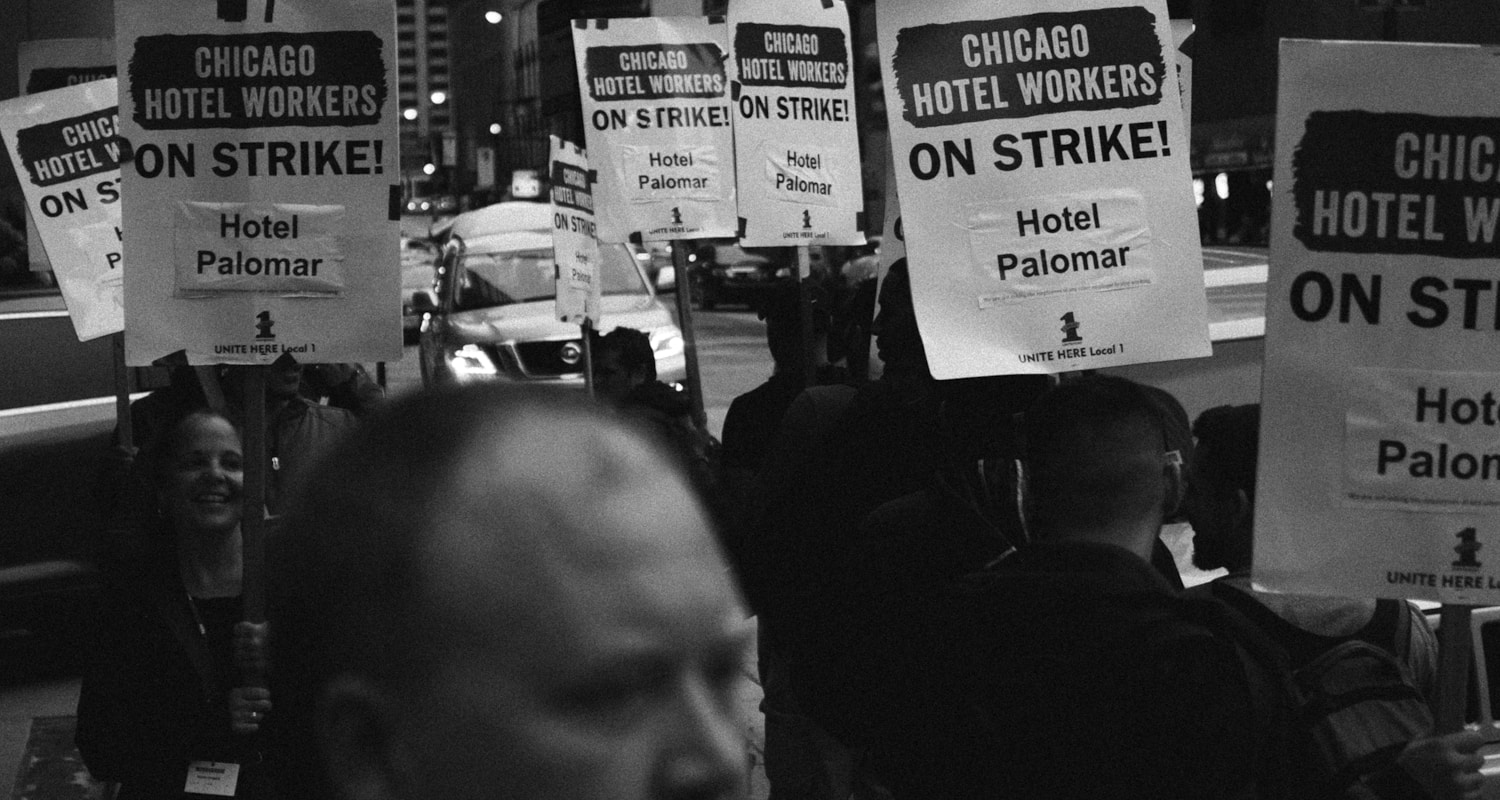

Industrial action occurs when a dispute in the workplace can’t be resolved through negotiation. There are three main forms of industrial action:

There are strikes – where workers refuse to work for the employer. There are actions short of a strike – where workers take action such as go-slows, overtime bans, or callout bans. And finally, there are lock-outs – a work stoppage where the employer stops workers from working.

Industrial action has been historically one of the main levers of pressure for employees to demand economic, political, and social change from employers and the government.

For example, on the economic side, the establishment of the 8-hour workday in the late 19th – early 20th century is an achievement of mass strikes, while, in the political arena, mass strikes also contributed to the fall of apartheid in South Africa.

Despite the fact that since the early 1980s workers’ share of national income is declining and workplace conditions are worsening across many advanced economies, major nationwide industrial action has also been declining dramatically.

The study, written by Giorgos Gouzoulis at the University of Bristol, argues that the financialization of households is an important overlooked missing piece and the reason behind the declining strike activity over the last fifty years. The term ‘financialization’, as Giorgos describes, is defined as the increasing dependence of nonfinancial actors on financial institutions and instruments, which, in turn, affects their behavior and strategies. In particular, since the 1970s, the financial sector has been increasingly financing households, with household debt ratios increasing rapidly across the globe and mortgages being the vast majority of new credit.

Recent studies have shown that the rising dependence on private credit has made indebted workers more self‐disciplined and risk‐averse in the workplace. This is mainly due to the fear of losing their job and defaulting.

The hypothesis of the study is that the aggregate rise in household debt is likely to be associated with the decline in strike participation, duration, and volume in the last fifty years.

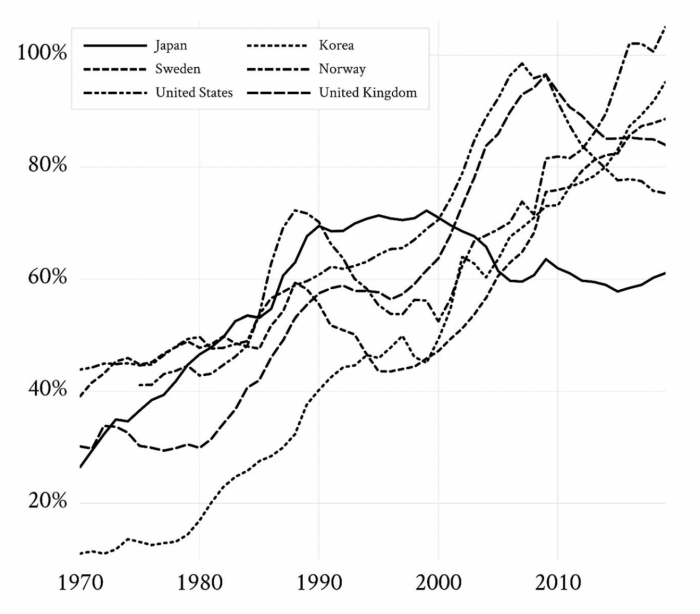

To prove this assumption, the paper focuses on Korea, Japan, Norway, Sweden, the United States, and the United Kingdom over the period between 1970 and 2018 using annual data from sources including ILOSTAT, World Bank, IMF, UNCTAD, and Visser.

Figure 1. Household debt to GDP ratios, 1970–2018. (Obtained from journal article)

The econometric findings in the paper show that the rise of household indebtedness in Japan, Korea, Sweden, the United States, and the United Kingdom can be associated with the decline in strike participation, duration, and volume. In Norway’s case, the process of financialization started later than the other countries of this study and more extensive debtor protection exists, making this relationship much weaker. Overall, the results provide core evidence that personal indebtedness and the corresponding default risk are strongly associated with the decline in strike activity rates.